Inhaltsverzeichnis

Flat rate evaluation

The lump sum evaluation enables you to close your accounts by allowing previously defined lump sums to expire directly and/or credit top-ups to be carried over to the new accounting period.

If the consumption flat rates are to be sent with the club's annual invoices or integrated into them, proceed as usual.

Create article

You are in the same account area in which your club contributions are created. When creating the articles, make sure that the allocation is correct based on the personal characteristics.

If your consumption allowance is collected from a different account, it may also make sense to use a separate account area for this.

These items are then allocated to the individual persons via the Automatic contribution allocation together with the club contributions to the individual persons and invoiced.

Transfer to another account area

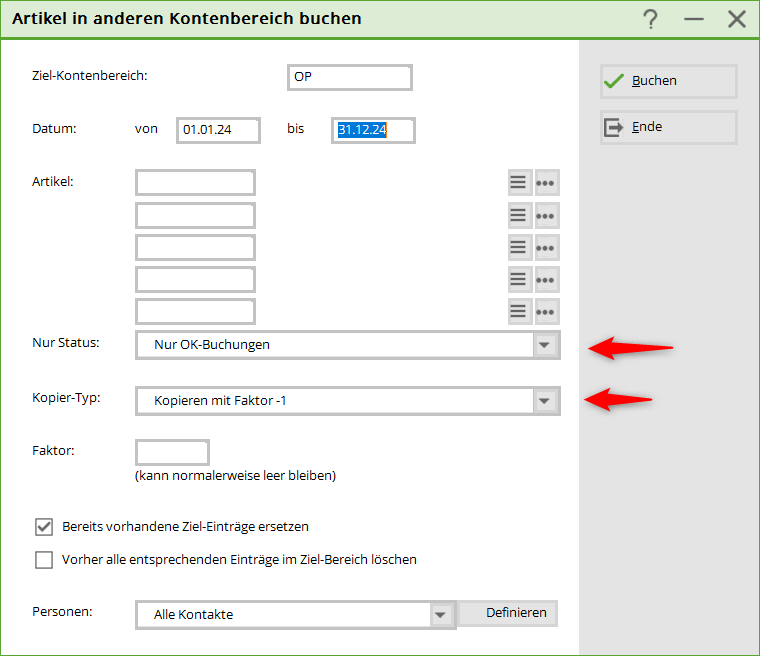

The invoiced lump sums must now be credited to the customer's accounts in the corresponding account area (here OP). To do this, go to the menu Turnover/Year-end closing/ Transfer individual postings to another account area.

Select the account area to which the transfer is to be made (normally OP,OPGASTRO or RECEIPT).

If you change the status from „Invoiced only“ to „OK bookings only“, a credit will only be transferred if the invoice has been paid with the consumption allowance.

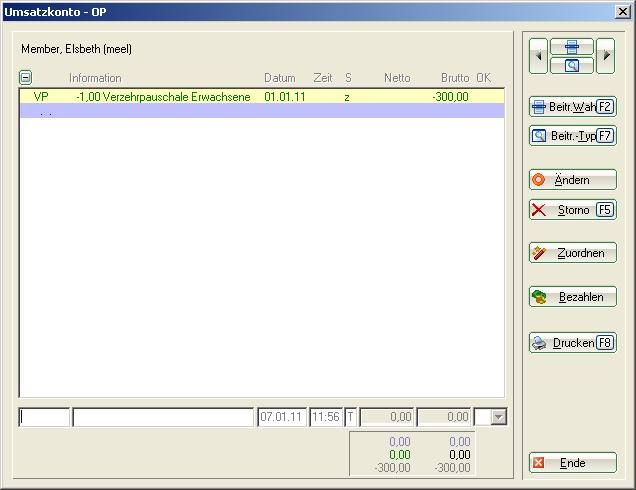

The item now appears as an open credit in the account for the individual persons.

Posting without invoicing

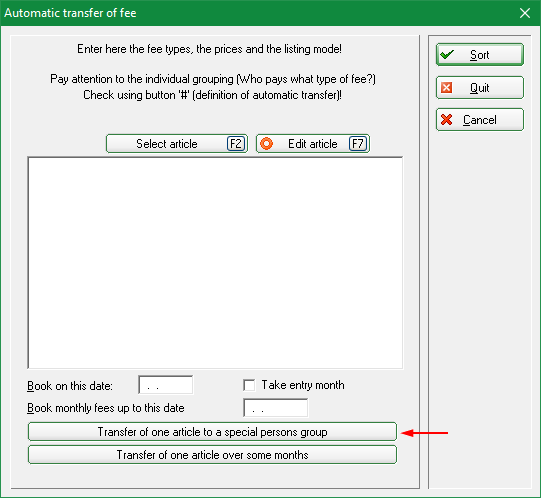

Do not create the annual invoices not via PC CADDIE, switch directly to the account area from which you create the catering invoices (normally OP, OPGASTRO or CATERING). Here you now select via Turnover/Automatic contribution allocation the function Assignment of individual articles based on special person groups.

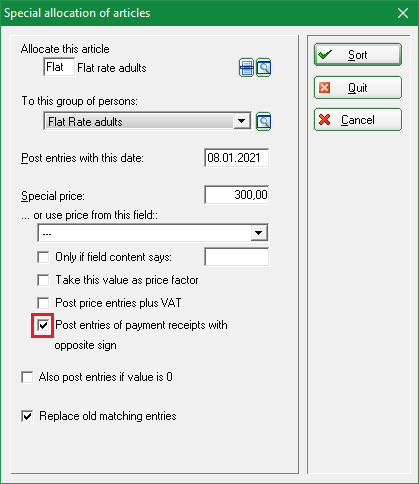

Please make sure that you tick the box here Post as incoming payment with reversed sign The amount is then posted to the account as a credit for the selected person group.

Bookings on account

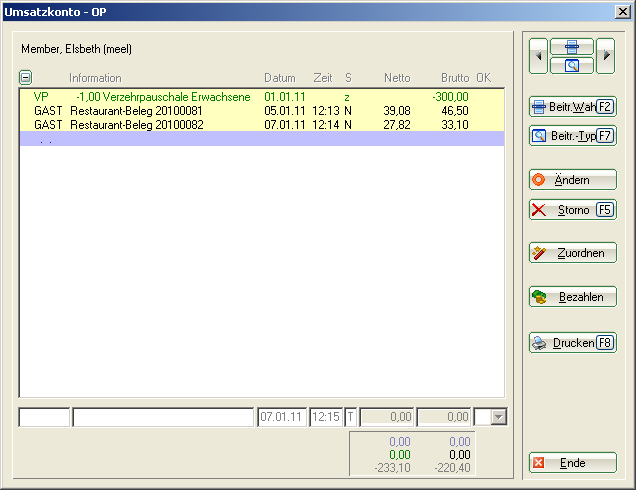

If consumptions are now posted openly on account during the season, they appear with the corresponding voucher number in the open item account of the persons.

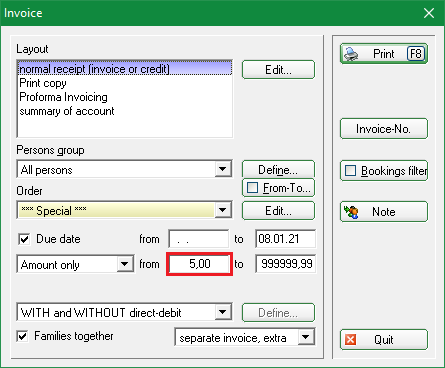

As soon as the account shows a „debt“ (consumption allowance included), an invoice is generated during the next invoice run. Under Turnover/Print/Invoices you define the minimum balance to be taken into account during the invoice run.

Print flat rate evaluation

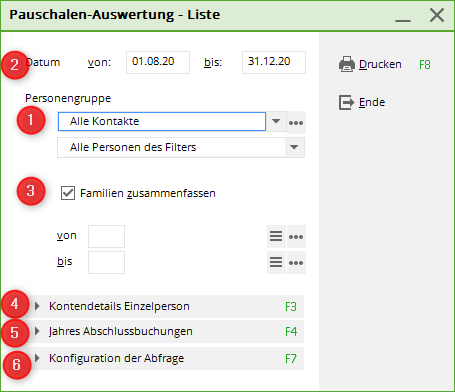

Account details individual

- Select the person/family either by entering the search abbreviation or the name, or via the list button on the right.

- Select the time period to be analysed.

- Decide how you would like the data to be analysed.

- This takes you back to the previous window

- This takes you to the year-end posting function

- This takes you to the more detailed settings for the year-end closing

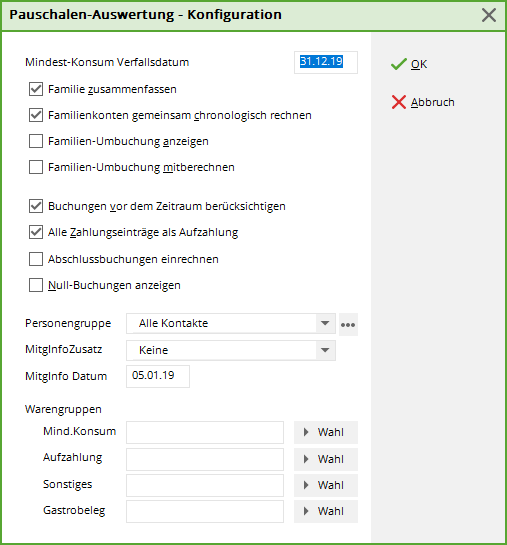

Configuration of the query

The configuration of the query is important for the year-end closing. This list is used to display what is posted at the end of the year. Depending on the club, customer credits are handled very differently.

- Minimum consumption → Product group of the consumption flat rate items

- Additional payment → Product group of payments or rebookings by the customer that do not expire

- Other → Product group of items that are not included in the flat rate

- Catering voucher → Material group for the carryovers from the catering account area

The other tick boxes are to be understood as follows:

- Summarise families

As soon as this box is ticked, the family account balance is displayed in the catering cash register for the individual family members. However, the consumptions are booked to the respective person as normal. This prevents a family member who has used up the lump sum from making additional payments even though another family member still has a remaining lump sum balance. If a family wishes to keep a separate bill, the additional info nfams must be entered for each family member.

For the group of persons, take into account that there are people who are contact persons but not members, etc. Create a filter for these persons. Create a filter that includes these people.

- Calculate family accounts together chronologically

Family accounts are counted as one account. Credits do not expire for the individuals, lump sums are calculated as a total. If the function is not activated, the lump sums are forfeited for the individual members of the family grouping. - Show family transfers

Transfers within the family are shown - Include family transfers

Family rebookings that were made through invoices are included in the total. - Include bookings before the period

The complete account is calculated. - All incoming payments as an additional payment

The payments made are calculated as a top-up payment. - Include closing entries

The closing entries are included. - Display zero postings

An account entry is made, even if the amount is 0. - Person group

Which persons should be included in the overview? - Additional information

Consumption is not in the account but in an info field. - WithInfoDate Info field should be posted to this date.

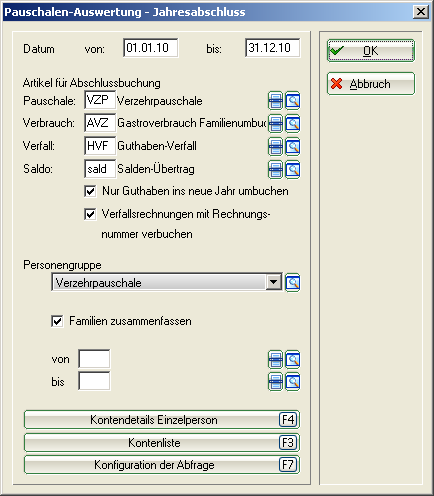

Year-end closing entries

The prerequisite for the year-end closing entries with possible carryovers is the creation of the respective articles, which are then assigned to the respective function.

| Flat rate | Posting or transfer of the flat rate to the account |

|---|---|

| Consumption | Catering consumption Transfers |

| Expiry | Remaining lump sums that expire are derecognised with this item |

| Balance | Account balance (credit balance due to deposits or debts) are posted again after closing |

| Last | Date of last consumption |

|---|---|

| Amount | Value of the last consumption |

| Flat rate | Value of the originally booked consumption flat rate (individual or family combined) |

| Payment | Payments made (in advance) |

| Consumption | Total amount of consumption |

| Other | Consumptions that were not charged against the flat rate |

| Residual lump sum | Residual value of the original lump sum after deduction of consumptions; the amount is forfeited |

| Balance | Current account balance (remaining credit minus consumption) |

| Residual balance | Credit or debt that is carried forward to the next year |

Any discrepancies must now be corrected. If the lists are in order, play it safe and make a Fast data backup . Then run the year-end posting.

Archiving the operating theatre area with consumption flat rates

The operating theatre or per diem area can be closed like a contribution account area after the per diem evaluation. However, you must be aware that the debt from the previous year is not offset against the consumption allowance in the new year. Although this appears to be the case in the account, it is not included in the flat-rate evaluation.

Balance carryovers have a special entry and of course cannot be offset against the consumption credit, as this is intended to cover everything from one year - something that comes in through an annual carryover therefore does not belong in the lump sum.

- Keine Schlagworte vergeben